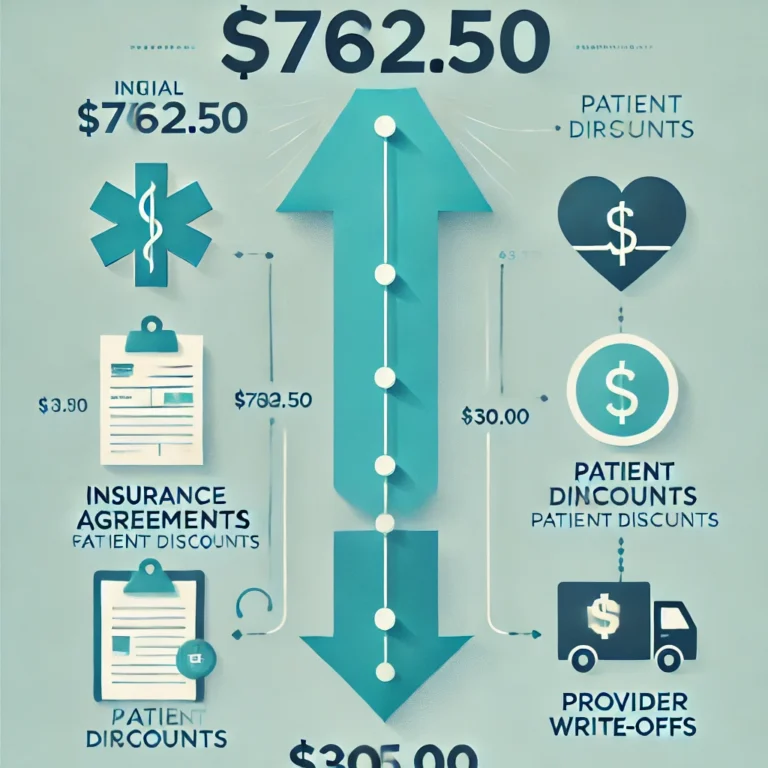

In medical billing, understanding how adjustments and refunds work can be challenging. Patients often receive statements with charges, adjustments, and sometimes unexpected refunds or reductions in the amount owed. If you have received a refund notice stating that a billed amount of $762.50 has been adjusted to $305.00, it’s important to understand why this happens and what it means for your payment: billed 762.50 refund to 305.00.

Why Do Medical Billing Adjustments Happen?

Medical billing adjustments are typically made to align the charges with insurance agreements, government regulations, and billing policies. In most cases, the initial billing amount reflects the standard charges for the service. However, adjustments occur based on:

- Insurance Agreements: Medical providers have agreements with insurance companies that determine negotiated rates for services. These rates are generally lower than the provider’s initial charges, leading to adjustments or discounts applied to the bill.

- Deductibles and Copays: When patients meet their deductible or have a specific copayment amount, the insurance provider may cover more, reducing the out-of-pocket expense for the patient.

- Billing Errors or Corrections: Sometimes, errors in coding or calculation result in higher charges. When the mistake is identified, an adjustment corrects the billing amount.

- Government Program Reductions: Government healthcare programs, like Medicare and Medicaid, often have predetermined rates for services, leading to reductions from the original billed amount.

Explaining the Adjustment from billed 762.50 refund to 305.00

When an adjustment from billed 762.50 refund to 305.00 occurs, it may involve a mix of insurance reimbursements, provider write-offs, or discounts based on financial assistance. Here are some common reasons why this adjustment might occur:

- Insurance Negotiated Rates

Most insurance companies negotiate rates with healthcare providers. If a patient is billed $762.50 but the insurance company has a contract rate of $305.00, the provider will adjust the billing amount to meet the agreed-upon rate. - Patient Responsibility Reductions

In some cases, the patient may qualify for a reduced rate due to financial hardship, charity care, or special assistance programs. This could lead to an adjustment that decreases the amount owed to $305.00. - Provider Write-Offs

If a provider determines that the initial amount billed is excessive or if there was a coding error, they may apply an internal write-off, which would reduce the billing amount to a lower figure, like $305.00. - Government Program Regulations

Patients using Medicare, Medicaid, or other government-backed healthcare may have services reimbursed at specific rates. If the billed amount exceeds what the government program allows, the provider must adjust the bill accordingly.

Understanding Common Terms in Medical Billing Adjustments

Familiarizing yourself with medical billing terminology can be helpful in understanding how your medical bill is processed. Here are some commonly encountered terms:

- Allowed Amount: The maximum amount an insurance company will cover for a service. The difference between the billed charge and allowed amount may be adjusted.

- Adjustment: The amount reduced from the billed charges, based on insurance agreements, billing policies, or other factors.

- Copayment (Copay): The amount a patient is required to pay out-of-pocket at the time of service, typically based on insurance coverage.

- Deductible: The amount a patient pays before the insurance begins covering services. Once the deductible is met, the patient may receive reduced charges on future services.

- Explanation of Benefits (EOB): A document from the insurance provider explaining what charges were covered, adjusted, or denied and the remaining patient responsibility.

Steps to Take If You Don’t Understand the Adjustment

When faced with an unexpected adjustment, taking the following steps can help you understand the reason behind it: billed 762.50 refund to 305.00

- Review the Explanation of Benefits (EOB): Check your EOB statement, which provides a breakdown of the initial charges, allowed amounts, adjustments, and the final amount you owe.

- Contact the Provider’s Billing Department: If the adjustment seems unclear or if you have questions about specific reductions, contacting the billing department is often the quickest way to get clarity.

- Check for Any Potential Errors: If the adjusted amount doesn’t seem accurate, there could be a mistake in the coding or billing process. It’s always good to verify the calculation with the billing department.

- Contact Your Insurance Provider: Sometimes, the insurance company can clarify if the adjustment is related to network discounts, negotiated rates, or other policy-related adjustments.

- Explore Financial Assistance Programs: If the adjustment is related to financial assistance, asking about available programs may provide further insights into any eligibility criteria or additional discounts.

How to Avoid Surprises in Medical Billing

Medical billing adjustments can sometimes be confusing and stressful. Here are some proactive steps you can take to avoid surprises and better understand your medical costs:

- Verify Coverage Details: Before scheduling appointments or procedures, confirm coverage details with your insurance provider. Knowing what is covered and the likely out-of-pocket costs can help set expectations.

- Ask About Fees Upfront: Request a cost estimate from the provider based on your specific insurance plan, deductible status, and copay requirements.

- Stay In-Network: Insurance often provides higher coverage for services within its network of providers. Choosing in-network providers reduces the risk of unexpected billing adjustments.

- Review Statements and Bills Promptly: Reviewing your medical bills, EOB, and any statements as soon as they arrive helps identify discrepancies sooner. Addressing potential errors or misunderstandings right away can save you time and stress.

- Inquire About Payment Plans: Many providers offer payment plans or options for reduced fees, which may help make large medical bills more manageable if an adjustment does not apply.

Conclusion

Understanding why a medical bill may be adjusted from an initial amount, billed 762.50 refund to 305.00 can demystify the billing process and help patients feel more in control. Whether it’s due to insurance agreements, government regulations, or financial assistance, knowing the factors at play can ease the experience of managing healthcare costs. Taking proactive steps—such as reviewing coverage details, understanding common billing terms, and communicating with billing and insurance representatives—can make the process smoother and more transparent.